The Empire State gave Square a "bitlicense" so users can trade cryptocurrency through the app.

Square's Cash App has officially been approved by the State of New York to handle cryptocurrency transfers after expanding the feature to other states last year.

Users will now be able to trade Bitcoin using the app, which is only the 9th company to receive a virtual currency license or "bitlicense" by the New York State Department of Financial Services. Only Xapo, Genesis Global Trading, bitFlyer USA, Coinbase, XRP II and Circle Internet Financial have received licenses and two more have gotten charters.

"DFS is pleased to approve Square's application and welcomes them to New York's expanding and well-regulated virtual currency market," said Financial Services Superintendent Maria Vullo.

"DFS continues to work in support of a vibrant and competitive virtual currency market that connects and empowers New Yorkers in a global marketplace while ensuring strong state-regulatory oversight is in place."

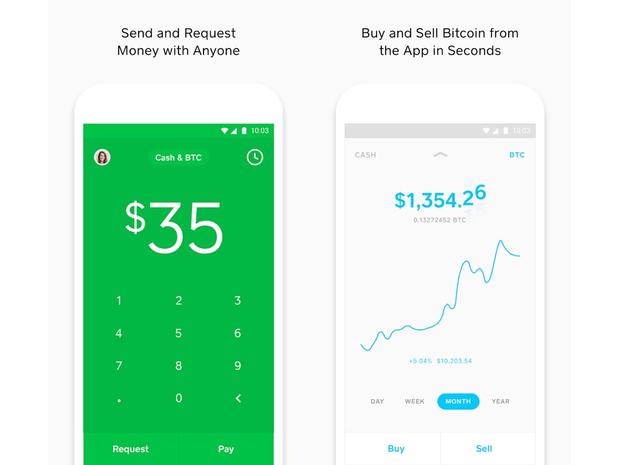

The Square Cash app is battling Venmo and PayPal for finance app supremacy, shooting to the top of the App Store rankings recently. In addition to payments between friends or colleagues, the app will now allow customers to buy and sell Bitcoin and other cryptocurrencies.

They are sure to gain more users following this recent announcement. Square, founded by Twitter CEO Jack Dorsey, has been a big backer of cryptocurrencies and announced back in January that the Cash App would soon be able to handle cryptocurrency transfers.

"The world ultimately will have a single currency, the internet will have a single currency. I personally believe that it will be Bitcoin," Dorsey told a newspaper in March.

Last fall, a Square spokesperson told Forbes that the company was looking into expanding access to cryptocurrencies and wanted to be able to facilitate all financial transactions, including those using digital currencies.

"We're always listening to our customers and we've found that they are interested in using the Cash App to buy Bitcoin. We're exploring how Square can make this experience faster and easier, and have rolled out this feature to a small number of Cash App customers," the spokesperson said. "We believe cryptocurrency can greatly impact the ability of individuals to participate in the global financial system and we're excited to learn more here."

Dorsey then officially announced the move in January, writing on Twitter, "Instant buying (and selling, if you don't want to hold) Bitcoin is now available to most Cash App customers. We support Bitcoin because we see it as a long-term path towards greater financial access for all. This is a small step." He also added in a link to a website explaining Bitcoin and its history.

The New York Department of Financial Services lauded the company for its efforts to help users "start, run, and grow their businesses." In addition to managing transactions, the company has both hardware and software that "manage inventory, locations, and employees; provide powerful business analytics; access financing; and utilize tools to engage with their customers."

"We are thrilled to now provide New Yorkers with Cash App's quick and simple way to buy and sell bitcoin," Head of Cash App Brian Grassadonia said.

"Square and the New York State DFS share a vision of empowering people with greater access to the financial system and today's news is an important step in realizing that goal."

*This article was featured on Download.com on June 21, 2018: https://download.cnet.com/blog/download-blog/you-can-now-trade-bitcoin-with-square-cash-app-in-new-york/